How can Salesforce help with loan management?

Companies that use Salesforce as a loan management system are already ahead of the curve, with the ability to automate many origination and risk management tasks. Those that use Chargent as an add-on to Salesforce, extend the abilities of their loan management software by making the loan repayment process flexible and secure.

Why choose Salesforce for banking apps?

“With our banking apps built on Salesforce, we can deliver more services to understand communities.” Support integral B2B and B2C processes on the world's #1 CRM. Use powerful insights to better support field reps, partners, and customers.

What can Salesforce do for You?

Build trust with seamless, secure mobile and digital experiences. Reduce onboarding complexity, deliver personalized interactions, and manage volume with AI and self-service options. “With our banking apps built on Salesforce, we can deliver more services to understand communities.” Support integral B2B and B2C processes on the world's #1 CRM.

Why do lenders need loan servicing software?

Some of the reasons lenders need loan servicing software are: Loan servicing software boosts customer satisfaction. As has been mentioned, it’s clear to see that consumers are moving more and more toward quick-and-easy online solutions for just about everything.

Why use Salesforce for financing?

When you make use of Salesforce to manage customer information for financing, you have the benefit of easily accessing and recording basic contact information, past sales, and other historical information . Salesforce can help progress your lending processes in several other ways too, enabling you to:

What happens if instant approval is not possible?

If instant approval is not possible on your end, at least you will be receiving more complete applications, more quickly, and from more applicants. Create A Unified Experience: Salesforce unifies the lending experience and provides the technology that each party needs to manage their end of the loan.

Is Salesforce a payment tool?

Salesforce is a powerful customer relationship management tool, but it has its limitations when it comes to payments. The Chargent add-on removes these barriers and gives lending businesses a flexible payment solution that can be customized to their particular business model.

Is Salesforce a loan management system?

Companies that use Salesforce as a loan management system are already ahead of the curve, with the ability to automate many origination and risk management tasks. Those that use Chargent as an add-on to Salesforce, extend the abilities of their loan management software by making the loan repayment process flexible and secure.

Can you add Chargent to Salesforce?

Adding Chargent is a no-brainer if you want to get the most out of your Salesforce loan management system. With it, you can process deposits, establish payment schedules, and confirm payment methods – all within the Salesforce CRM and at the click of a button.

Does Chargent work with Salesforce?

Chargent works in Salesforce Communities as well, enabling your customers to update their payment methods, select payment plans, schedule payments, and more. When it comes to servicing loans, there’s one add-on that you should definitely consider – Chargent.

Is the lending process slow?

The lending process shouldn’t seem slow and confusing to your customers. They don’t want to fill out paperwork by hand, wait days for loan approvals, or go out of their way to send in checks every month – and with today’s technology, they shouldn’t have to.

When it comes to lending, things are moving faster than ever before. Make sure your firm can keep up. Why Salesforce for lending

Disparate systems and manual processes are no longer sustainable, and oftentimes can lead to lost opportunities or closed accounts. Leverage the power of Salesforce for lending to meet and exceed the needs of your customers with a single platform.

Mortgage

Iron out your mortgage and consumer lending processes to ensure your customer’s journey goes as planned.

Small Business Loans

Adapting to regulatory changes can be hard, and your customers look to you to make the process simple.

Managing Forbearance

Address borrower concerns in times of need without overloading call centers.

Commercial Lending

Track and automate your commercial team’s progress as you eliminate manual processes and effectively tackle the competitive landscape.

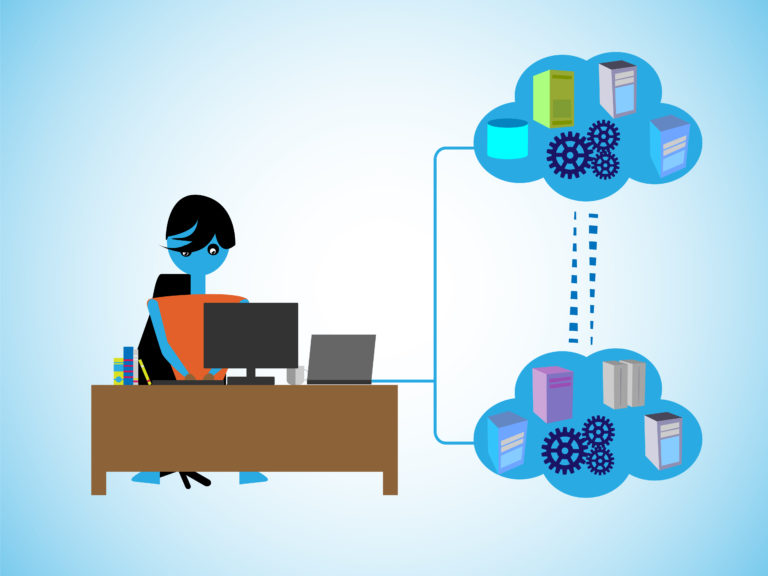

Lending integrations

Connect your data to improve your processes and create better lending experiences.

What is loan origination system?

The best loan origination systems are designed to give you flexibility in creating a process that matches the unique needs of your lending practice. While Salesforce-based solutions cover the lending cycle, the loan origination portion of the process may not be as efficient and profitable as solutions designed specifically for lenders. Specialists may have the edge in responding to some loan applications.

What is cloud based machine learning?

Cloud-based, advanced machine learning techniques analyze loan applications and detect false identity, collateral inflation, and other subtle or obvious misrepresentations of information that strongly correlate with a high probability of default.

What is alternative credit data?

Alternative credit data is an aggregation of payment information—utilities, mobile phone, cable, and rent, along with changes of address, real estate, or bankruptcies —that provide a better understanding of an applicant’s ability to pay. Trended credit data provides up to 30 months of tradeline data to reveal improving, declining, or stable credit habits that give a lender a clearer picture of an applicant’s current financial standing.

Does Salesforce have a lending platform?

Salesforce has developed a lending solution built on its CRM platform. Financial services providers that have invested in Salesforce and want to start or improve lending will probably kick the tires on it. Let’s look at its pros and cons.

What is Salesforce Loan Officer Console?

Salesforce offers a single window application for loan officers known as Loan officers console where the loan officers can. see the new leads which are coming in, the context of lead origination. qualify the prospects.

What is the widening engagement gap between borrowers and lenders?

The widening engagement gap between borrowers and lenders is a cause of concern in the Mortgage Industry. Borrowers with access to the most sophisticated technologies expect a personalized, one-touch, technology driven, streamlined and simple mortgage experience. Lenders with strict regulatory compliance, low rates, complex process and reluctance in adopting newer technology are a long way from meeting those expectations.

What is the Salesforce Cloud for the Mortgage Industry?

Financial Services Cloud for the mortgage industry is a one-stop broader Salesforce Customer 360 platform that aims to streamline the mortgage process from the pre-application stage to post-close across sales, servicing, marketing, integration, application development & analytics.

Brands Who Trust and Believe in the New Mortgage Innovation for Salesforce Financial Services Cloud

Top brands who are already involved in Salesforce financial cloud for mortgage industry & their experience so far:

Final Words on Salesforce Financial Services Cloud for Mortgage!

To enhance the mortgage origination process and help borrowers explore the digital mortgage process, Salesforce released its mortgage innovation.

What is LoansNeo?

It empowers NBFCs to manage all facets of loan servicing operations straight from lead capture to customer acquisition at a very rapid pace. The solution automates most of the loan lifecycle processes such as Loan Application and Approval, EMI Scheduling, Amortization, Tracking of payments, Penalties, or Charges for delayed payments– with transparency, competency, and efficiency.

What is nonprofit solution?

Nonprofit Solution provides a 360-degree view of your mission with efficient Donor Management, Client Management, Campaign Management, Project, and Expense Management functions . With intuitive reports and sleek dashboards, the performance of the organization on metrics such as Donor Acquisition, Event Performance, Fund-raising, and Campaign Performance can be analysed and shared with stakeholders.