CLV is calculated by taking the average revenue per customer and multiplying it by the average customer lifetime. For example, if your average customer generates $100 in revenue during his or her lifetime, and your average customer lifetime is 3 years, then your customer lifetime value is $300.

How do you calculate CLV in sales?

The Simple CLV Formula The most basic way to determine CLV is to add up the revenue earned from a customer (annual revenue multiplied by the average customer lifespan) minus the initial cost of acquiring them. (Annual revenue per customer * Customer relationship in years) – Customer acquisition cost

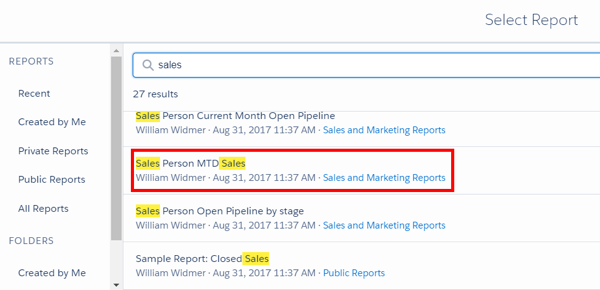

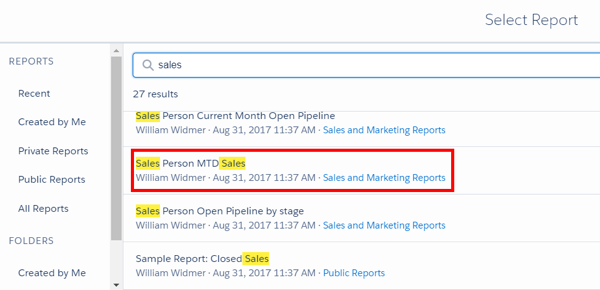

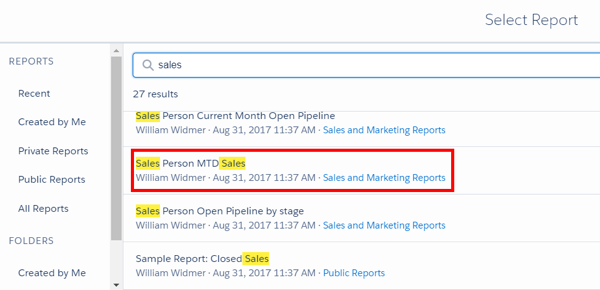

How do I create a lifetime value model in Salesforce?

Go to Intelligence > Predictions. Select the Customer lifetime value tile and select Use model. In the Customer lifetime value pane, select Get started. Name this model and the Output entity name to distinguish them from other models or entities. Select Next.

How to calculate the expected customer lifetime value in CRM?

When calculating the expected customer lifetime value, you are using the present and historical customer data in your CRM to make a calculated prediction about the future and potential value of your customer segments. You are using the cancelled customers in your segments as the baselines for the survival (retention) rates in each segment.

How to increase your customer lifetime value (CLV)?

Offering better customer service and a consistent user experience will keep your clients satisfied and lengthen your average customer lifespan. This also allows you to recognize opportunities for upselling and cross-selling, which would further boost your CLV. 3.

What is CLV in CRM?

What is Customer Lifetime Value (CLV)? Customer lifetime value (CLV) is the total amount of money a customer is expected to spend in your business, or on your products, during their lifetime.

How do you calculate lifetime value of a customer?

Customer Lifetime Value = (Customer Value * Average Customer Lifespan) To find CLTV, you need to calculate the average purchase value and then multiply that number by the average number of purchases to determine customer value.

How do you calculate CLV in SaaS?

To calculate the lifetime value of a SaaS customer, you can use this formula: CLV = [0.5 * 1 / churn * (2 * ARPA + ARPA_growth * (1 / churn – 1))] * margin, where ARPA represents the Average Revenue per Account.

How do you calculate discount rate for CLV?

The calculation of CLV (WITH discounting) would be:Year 0 = – $1,000 acquisition costs divided by 1 (no discount)Year 1 = $1,000 customer profit divided by 1.1 (10% discount) = $909.Year 2 = $1,500 customer profit X 75% retention divided by 1.21 (10% X 10% discount) = $930.More items...

What is the difference between CLV and LTV?

Lifetime Value (LTV) shows the amount that customers will bring over the total time they interact with your company. While Customer Lifetime Value (CLV) shows how much a customer will bring over the total time they interact with your company.

What is a good CLTV value?

Experts in the field such as David Skok suggest a 3 to 1 ratio on CLTV/CAC. For every dollar of customer acquisition cost (CAC), you should be returning $3 of customer lifetime value. I view CLTV/CAC as the return on your customer acquisition investment.

Is it necessary to calculate CLV precisely?

It may not be a perfect or foolproof metric, but it's invaluable when used correctly. It helps with business planning and budgeting, and makes it easier to keep your expenses in check. So how do you calculate CLV? This depends in part on your business model, and in part on what's right for you and your business.

How to calculate CLV?

The most basic way to determine CLV is to add up the revenue earned from a customer (annual revenue multiplied by the average customer lifespan) minus the initial cost of acquiring them.

What is CLV in marketing?

Looking at CLV can help you define clear marketing goals and sales strategies to reduce acquisition costs, improve retention, and encourage existing customers to spend more over their lifetime with your company.

Why is CLV important?

For most businesses, a small cohort of specific customers is generally the most profitable . Assessing your CLV can allow you to dedicate more resources toward the acquisition and retention of high-value customers – thereby increasing profits overall.

What is CLV without measuring?

Without measuring CLV, a business might be spending too much to acquire customers whose lifetime value simply isn’t worth the cost. Once you’ve identified your most valuable group of customers, you can focus on providing customer service tailored to their needs to ensure they stick around as long-term clients.

How to increase retention of customers?

1. Create a Loyalty Program. In centivize repeat purchases and you’ll automatically increase retention along with the lifetime value of your customers. Repeat customers are always more profitable than those who make a single purchase - and they cost less to retain than acquiring a new client.

What is CLV in marketing?

Customer Lifetime Value (CLV) is a prediction of the expected net profit from a customer over their entire relationship with your brand. Many brands calculate CLV as a lagging indicator, meaning they look at past purchases. However, calculating CLV as a leading indicator, or a prediction or future buying, allows brands to better allocate marketing ...

How much of the data goes unanalyzed?

However, according to Forrester, 60% to 73% of this data goes unused or unanalyzed.

Is the previous model going to predict the future?

The previous models and forecasts aren’t going to accurately predict the future. Harvard Business Review said, “ Businesses should not take for granted the data they gathered before COVID-19 will accurately predict buyer behavior in the socially distant economy.”.

What is customer lifetime value?

The customer lifetime value equation essentially views a customer as an income stream. So instead of considering the customer’s purchases as single transactions, the marketing focus becomes creating ongoing series of profitable transactions. These ongoing transactions are created through customer relationship management practices and strategies – with the success of CRM activities being measured by improvements in the firm’s customer lifetime value.

When was CRM first used?

Customer relationship management or CRM developed in the 1980s primarily through service firms that had direct contact with their customers. Prior to that time it was essentially a business to business marketing strategy. CRM became very popular marketing concept in the 1990s and is still quite critical to many service industries.

When did CRM become popular?

CRM became very popular marketing concept in the 1990s and is still quite critical to many service industries. The concept of customer relationship management is to manage individual customers (or segments customers) through various relationship stages. Ideally we take a non-consumer (sometimes referred to as a prospect) ...

Is a first time customer a trial purchase?

In most cases, a first-time customer is really making a trial purchase and may never repurchase the product/brand again. There are also likely to buy in small quantities initially. Either way, it should be clear that a first-time customer is generally relatively low in profit the firm.

Does increased up selling cost reduce customer lifetime value?

Therefore, increased up selling costs may result in a reduced customer lifetime value. Increasing customer lifetime value is not simply a matter of spending additional money in customer acquisition, retention and up selling – rather spending the money appropriately across those three areas, depending upon the value, ...

What is Customer Lifetime Value?

Customer Lifetime Value (CLV) represents the predicted net profit that a customer generates throughout their relationship with a company. Instead of looking solely at the value brought by a customer at their first purchase, CLV helps you calculate how valuable that customer could be for an unlimited period.

Why is Customer Lifetime Value Important?

Customer Lifetime Value is one of the most important metrics because it shows you how healthy your business is and keeps all your departments focused on bringing the most value and generating the most profitable customers.

Customer Lifetime Value Example

Customer Lifetime Value varies from a business to another, from an industry to another.

Tips to Increase Customer Lifetime Value

Although retaining customers is cheaper than acquiring new ones, it’s not necessarily easier. It takes time to win your customer’s trust. Details that seem insignificant can put an end to a lasting relationship.

What is CLV in accounting?

CLV = customer value X average customer lifespan. The resulting CLV is a monetary value (depending on the currency you work in) and shows how much you can reasonably expect the average customer to spend with you over their lifetime.

How to calculate average purchase frequency?

Average purchase frequency — divide the number of purchases in that same time period by the number of individual customers who made a transaction over the same period. Customer value — the average purchase frequency multiplied by the average purchase value.

What is expected customer lifetime value?

Expected customer lifetime value is a financial calculation that forecasts the potential value of a customer based on the present and historical data you have of current and cancelled customers.

What happens when you acquire a new customer?

The day you acquire a new customer, their potential value starts decreasing. You can lose potential value at any point if the relationship is burned too quickly, the partnership soured, or the customer leaves you to go to a competitor.

Is it possible to capture all the potential value of a customer?

While a customer might look very profitable at first glance with really high potential value, it is not always so easy to capture that potential. It’s also not likely that you will ever capture all the potential value of any single customer in the lifetime you have a business relationship with them.

Do you need a CRM?

You must have and use a CRM (like Salesforce or similar) and; The CRM must store customers uniquely (little to no duplication). The CRM must contain the status of the customer’s relationship (Ex: current customer, cancelled customer, or prospective customer) along with dates of those status changes.