Go to POS settings > Sales Tax > click New Sales Tax Secondly, you will need to add your Avalara account details in Account settings > Settings > and scroll to the AvaTax Settings section. How it works Once you have this setup, the system will automatically look up the local sales tax rate and add it to the account if a new tax rate is found.

- Open the installation folder you downloaded from AvaTax, and then click the Package Location download link.

- On the Package Install page, select Install for All Users, and then click Install.

What is avatax and how does it work?

Avalara AvaTax is an advanced solution that uses geolocation and address verification to calculate sales tax down to a specific address, accounting for multiple tax jurisdictions in a single ZIP code, complex tax tiers, and more. If you need to calculate tax on international transactions, AvaTax offers an option for that too.

What is Avalara avatax and Avalara returns?

Avalara AvaTax provides cloud-based sales and use tax calculation with comprehensive, up-to-date tax rates pushed to your shopping cart or invoicing system, automatically. Avalara Returns uses your sales data to prepare and file your sales and use tax returns, and remit payments, across multiple jurisdictions every filing cycle.

How do I set up a company in Avalara?

A company in Avalara is a model of your business from a sales tax and consumer use tax perspective. If you have a multi-company organization, add the additional companies. Add the parent company first, if your organization has parent company/child company relationships. Gather the information you need to set up a company.

Why Avalara for Salesforce tax compliance?

The teams involved with our tax compliance upgrade have been incredibly responsive, and they work great together.” In addition, Avalara has integrations to the order management, point-of-sale, and ERP systems most commonly used with Salesforce as well as an open API to handle any custom projects.

How do I set up AvaTax?

Set up AvaTaxCreate a basic company profile. Start by telling us a little about your company and where you're registered to collect and pay tax.Connect to AvaTax. Get your transactions flowing to AvaTax for automated tax calculation. ... Fine-tune your company profile. ... Test your setup. ... Set up Returns.

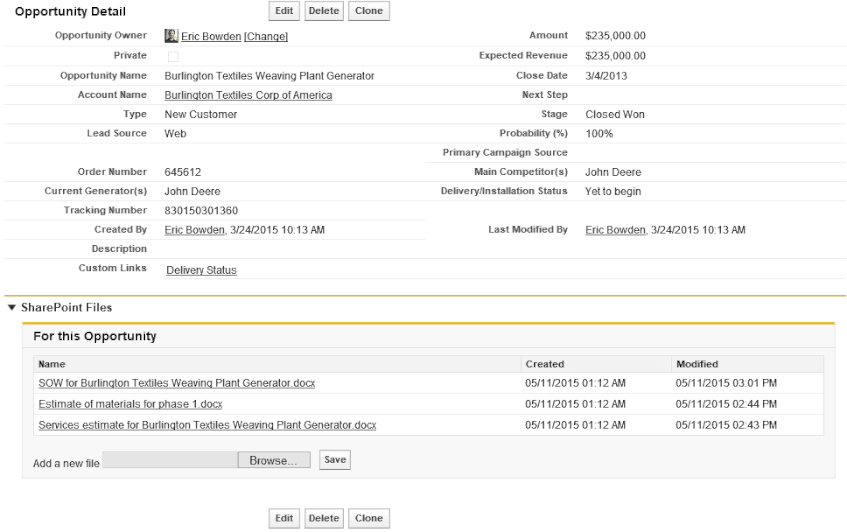

How does Salesforce integrate with Avalara?

In Avalara, go to Settings > Integrations. Select See Connector Versions for the appropriate Connector for Salesforce Sales Cloud version (sandbox or production), and then select the most recent version. In Salesforce Sales Cloud, on the Package Install page, select Install for All Users, and then select Install.

How do you integrate Avalara?

Get your integrationIn Avalara, go to Settings > Integrations. ... On the Manage tab, on the tile for your integration, select See Connector Versions and then select Download next to the latest version. ... Find your platform to get the steps to continue setting up your integration.

Is AvaTax free with Shopify plus?

Avalara AvaTax is a paid service available for Shopify Plus plans only.

What is a sales tax engine?

A tax engine is software that is fully integrated into your ERP, CRM, or e-commerce system - designed to keep you on top of sales and use tax laws, as well as international tax regulations such as VAT and GST. It ensures that tax is correctly calculated and applied to your business transactions.

Does TaxJar integrate with Wix?

How to connect Wix Automations + TaxJar. Zapier lets you send info between Wix Automations and TaxJar automatically—no code required. Uses of your pre-defined automation rules as a trigger. automatically do this!

How do I connect my AvaTax to Shopify?

Steps:From your Shopify admin, go to Settings > Taxes and duties.In the Tax services section, click Install app. If Tax services doesn't appear on your Taxes and duties page, then contact Shopify Plus Support.Click Connect an existing account.Enter your Avalara Account number and License key.Click Save.

What is the difference between Shopify and Shopify plus?

To recap, Shopify and Shopify Plus have the same core offering when it comes to the dashboard and basic eCommerce functionality. The main difference is that Shopify Plus gives you a lot more flexibility, more support options, and more access to your store's underlying code.

Does Shopify automatically collect sales tax?

Shopify's built-in tax engine automatically collects sales tax for you, from wherever you tell it to - even if you have sales tax nexus in more than one state. To turn on sales tax collection in Shopify, simply go to Settings > Taxes. The Shopify Tax Manual quickly and thoroughly walks you through setting up sales tax.

What is Avalara's solution?

Avalara's solution tracks your economic nexus tax liabilities in states where you're potentially obligated to collect. Detailed reports will alert you when you're about to trigger tax obligations in new states.

Does Avalara require a full address?

Yes, but for the most reliable rates, Avalara needs an accurate and complete address, or the latitude and longitude (U.S. only), in order to calculate tax.

What is Avalara software?

Avalara is the industry's most trusted provider of sales and use tax automation solutions and is one of America’s fastest growing companies earning recognitions including Deloitte’s 2013 Technology Fast 500™.

Where is Avalara located?

Avalara. Headquartered on Bainbridge Island, WA, Avalara is the recognized leader in web-based sales tax solutions, and is transforming the sales and use tax compliance process for businesses of all sizes.

How does Avalara work?

Step 1: Avalara provides tax codes that determine the taxability of the products you sell. Tax codes identify the category that a product belongs to and determine the tax rules that apply to a product. If you are selling products that need to use a different code or products that require special tax treatment, then you can change the tax code for those products.

Does Avalara work with Dynamics GP?

Avalara AvaTax must be already installed in your Microsoft Dynamics GP system. Avalara provides full resources that walk you through installation and configuration of Avalara AvaTax for Microsoft Dynamics GP: Avalara for Microsoft Dynamics GP Implementation and Avalara Help Center for Microsoft Dynamics GP.