Go to your Donation Object and add a new donation. Your donation receipt will be generated and emailed within minutes! Now, each time a donation is saved in Salesforce, you’ll automatically be generating and sending a tax receipt to the donor and saving hours each month.

What is the best way to generate tax receipts for nonprofits?

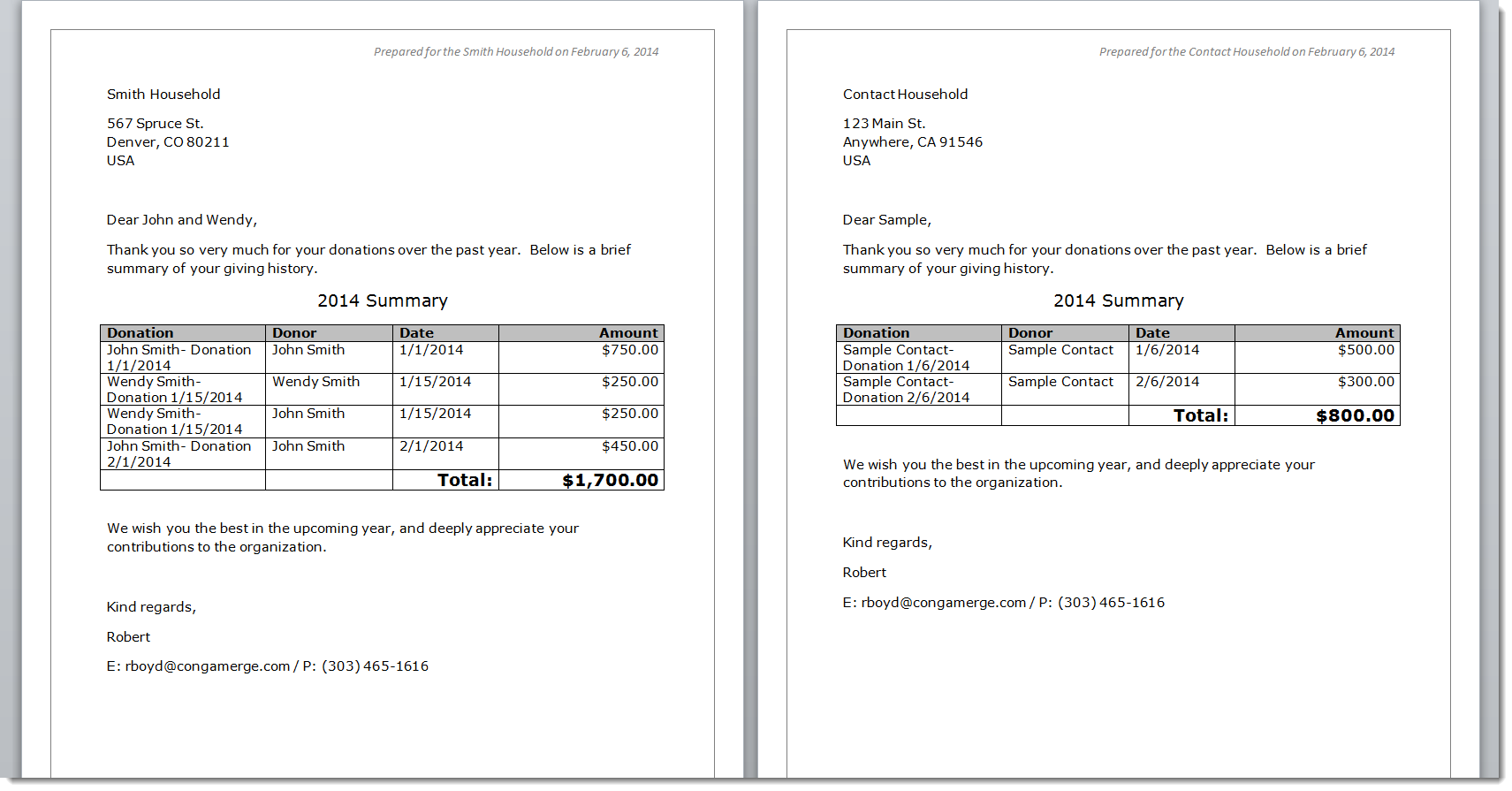

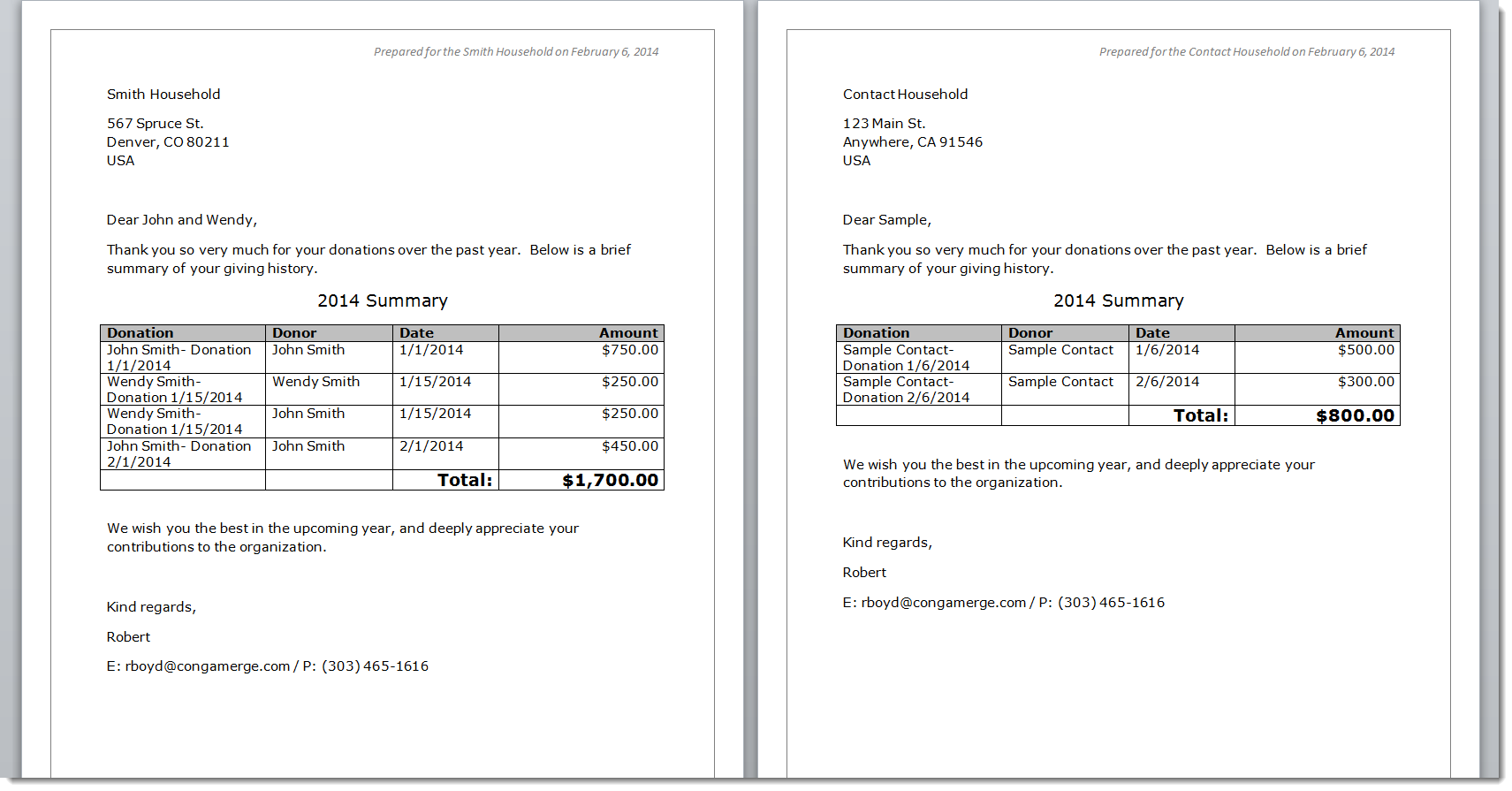

Generally, we recommend using a document generation app from the AppExchange that can automate your acknowledgment process for single letters, batches of letters, and annual tax receipts. These apps have an additional cost, but many are discounted for nonprofits.

How do I create a printed donation acknowledgement letter?

There are several different ways to create printed donation acknowledgment letters using Salesforce and NPSP, but they require a bit of extra time (and sometimes money), depending on your needs.

How do I send an email acknowledgment in Salesforce?

Then go to the actions menu, and select Email Acknowledgment. Selecting the email acknowledgment action will: Update the selected opportunity's Acknowledgment Status field to Email Acknowledgment Now. Trigger an automation (what Salesforce calls a workflow rule) that will send the email.

What are recurring donations and how do I track them?

We often use recurring donations to track donations from an individual who gives the same amount repeatedly, such as a monthly donor. NPSP supports two kinds of recurring donations: open-ended and fixed-length.

Can Salesforce process donations?

Salesforce.org Elevate is a powerful app that accepts and processes donations online, and automatically sends the donation data to NPSP.

How do I give a donation receipt?

“How Do I Write Donation Receipts?”The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.The amount given OR a description of items donated, if any.

What is donation receipt?

Donation receipts, or donation tax receipts, are a form of donor communication that provide official documentation of a gift made by a donor.

Can donation receipts be emailed?

When you send a donation receipt via email or snail mail, include the donor's name. Using their first name reassures them that the data is accurate and trustworthy. Also, use a real person's name and make the email address from which you send the donation receipt appear as human and as trustworthy as possible.

Can you invoice for a donation?

For nonprofit organizations and charitable organizations, presenting donors with detailed invoices is one way to demonstrate gratitude and encourage repeat donations. Most donors expect organizations to acknowledge the receipt of donations. By sending an invoice, it becomes easier to deepen relationships with donors.

How do I create a charitable tax receipt?

If the property has not been appraised, you must be able to justify the value of the property.Authorized signature. ... Registration No. ... Charity or qualified donee address. ... Charity or qualified donee name. ... Date gift received. ... Date receipt issued. ... Description of advantage to donor.More items...•

How do I keep track of donations received?

You'll need a record that includes the name of the charity and the date and amount of the contribution. One of the following, showing the date and amount of your contribution, can substantiate charitable contributions: A bank record, like a canceled check or a bank or credit card statement.

How do I record donations for a non profit?

The accepted way to record in-kind donations is to set up a separate revenue account but the expense side of the transaction should be recorded in its functional expense account. For example, revenue would be recorded as Gifts In-Kind – Services, and the expense would be recorded as Professional Services.

What information is required on a donation receipt?

Each donor receipt should include the charity's name and name of the donor. Many donor receipts also include the charity's address and EIN, although not required. The donor, however, is required to have records of the charity's address.

Do you need tax receipts for donations?

Some charities need a minimum donation before they can give you tax receipt. Some will only issue receipts for donations over $25, while others may issue receipts for donations less than $10.

What happens if you don't have receipts for donations?

Legal requirements: The IRS requires donation receipts in certain situations. Failure to send a receipt can result in a penalty of $10 per contribution, up to $5,000 for each specific campaign.

How do you log donations?

How to Record a Donation for BookkeepingUnderstanding What Constitutes a Donation. ... Recording a Donation. ... Establish Value of Contributed Assets. ... Create an Invoice to the Charity. ... Issue a Credit Memo to the Charity. ... Keep Detailed Records. ... Request an Acknowledgement.

What is Salesforce donation app?

Salesforce Apps for Nonprofits. As mentioned above, donation apps are among the most important tools that a nonprofit needs to make the most of Salesforce. A donation app should accomplish a few important tasks: Accept and process online donations. Allow donation forms to be easily integrated with your website.

How to optimize a donation form?

Consider these best practices for optimizing your donation form: 1. Balance your required fields to be thorough but concise. Your donation form is a great place to collect additional information on your donors, but the last thing you should do is slow down the process too much.

Can you report transaction data to Salesforce?

Directly report transaction data to your Salesforce database. If you’re new to Salesforce, never underestimate the value of automatic data reporting. This alone is the main reason why going with a Salesforce-integrated tool is almost always the best choice for organizations already on the platform.

Is Salesforce a CRM?

Salesforce is the world’s leading CRM platform for a few reasons, but chief among them is its flexibility. For nonprofits, whose projects, campaigns, and events rely on so many moving pieces, this level of flexibility can be a game-changer.

What about situations where a recurring donation isn’t open-ended?

What about situations where a recurring donation isn’t open-ended? For example, Candace’s employer, Cloud Kicks, is inspired by NMH’s work and wants to make a $10,000 donation to the NMH Transitional Housing Campaign in four quarterly installments. That’s a perfect fit for NPSP’s fixed-length Recurring Donation object.

How much does Candace donate to NMH?

Candace decides to become a sponsor with a monthly donation of $100.

Can you donate $50 a month in Salesforce?

Technically, a donor who gives $50 a month could be managed either way in Salesforce, with the difference being how you opt to solicit, track, recognize, and account for a donation as either a pledge or a recurring donation.

Learning Objectives

Your Salesforce Org: A Gift Processing Machine

Process Single Payments

Batch One-Time Transactions

Manage Recurring Donations

- Donors can create recurring donations by selecting the weekly, monthly, quarterly, or yearly donation options on a Giving Page. When they complete the transaction, your payment processor authorizes the payment and Elevate creates the associated recurring donation, opportunity, and payment records in Salesforce. You can also create a recurring credi...

Resources